The Trump Taj Mahal was as old school as they came, and for that reason (amongst others, such as great comping), I loved the property. The Taj, as its players so affectionately knew it, was the casino that was. The run down old property that, at one time, represented the pinnacle of opulence and extravagance in Atlantic City. The angel with a broken wing. It was almost like a beat up old car that isn’t going to sell as an, ‘Antique,’ due to its rough handling and lifetime of use as a daily driver, beat up, but in the right light and at the right angle, still shows a glimpse of what it once was.

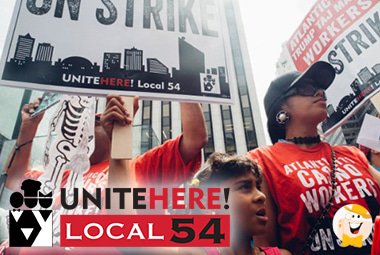

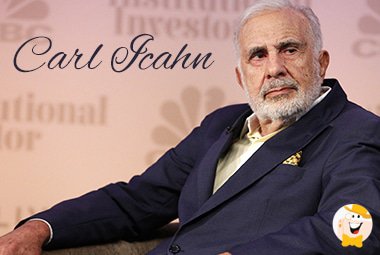

For those who followed my reporting on the state of affairs at the Trump Taj Mahal over last Summer, then you already know the Atlantic City Casino Union, Unite Here 54, initiated a strike against the Trump Taj Mahal casino that then-owner Carl Icahn, (Using past-tense in reference to his ownership sure feels good!) basically indicated would eventually doom the property.

The cliff notes version of the story is that Unite Here had a labor contract that they found acceptable with all of the casino properties in Atlantic City with exception to the Trump Taj Mahal. The union was somewhat incensed by the fact that Icahn had invested several million dollars into the property with plans to invest several million more in an effort to effectuate a turnaround. Unite Here, a couple of years before, had made several concessions purportedly to keep the Trump Taj Mahal operating, and sacrificed significant wages and benefits in that effort.

While, from the workers’ perspective, Atlantic City had entered into enough of a stabilization after the years 2014 and 2015 (even though, as a city, A.C. was not up, the individual casinos largely were due to several closures) that they should be restored to their previous working conditions, Trump Taj Mahal had not yet done that.

In my reporting on the matter, I pointed out that Trump Taj Mahal, unlike the other remaining locations on the shore, was still absolutely hemorrhaging money. In fact, the month before the strike just happened to be the only month that the property saw positive revenues against its operating expenses, even though it would have still lost money relative to the investments that were to come.

The strike also came at a bad time due to a degree of uncertainty with respect to future competition, not just competition out-of-state that could draw would-be Atlantic City visitors, but also, potential competition within the state. In November of 2016, voters roundly rejected a bill that would have authorized the building and opening of new casinos in Northern New Jersey that would have competed with the Shore for not just Jersey residents, but also, would have potentially cut the shore off from weekending New York City customers. Needless to say, while it never really looked like the bill would pass, the passage of it would have been devastating to the existent casinos and almost certainly would have sparked more closures.

It was for that reason that Icahn was sort of, ‘Standing pat,’ with respect to committing too many more funds into reinvesting on the property, and furthermore, why he was also hesitant to improve the working conditions by restoring the labor to the contracts into which they had entered with other casinos in the city. In addition to that, it bears reiteration that the Trump Taj Mahal’s lone positive month in years would not have been had they been paying out the wages and benefits in accordance with what the Union demanded.

Granted, Icahn could have made some concessions. For one thing, workers were not and had not been receiving paid breaks since their initial concessions, which is beyond ridiculous for any owner-labor situation. While it would presumably cost money that would otherwise have gone into property investments, it is often a good policy not to blatantly shit on your labor. I could understand where vacation time or health benefits may have been difficult, (especially given the likelihood that the employees would qualify for the ACA, anyway) but to not give any paid days for illness or to not give paid breaks is beyond the pale.

However, anyone with the economic training of a four-year old could see why a property that usually sheds money like unwanted clothing on a hot summer’s day could not afford to restore the full benefits package. Keep in mind that The Taj was not losing money because of the monies being reinvested into the property, it would have been operating at a loss regardless of those monies being invested one way or another.

Of course, we all know how the story ended up playing out, you had two different extremes (Icahn & Unite Here) who both seemed unwilling to meet anywhere that would have been meaningfully in the middle of the two positions. While the casinos opening in Northern New Jersey (had that happened) would have certainly doomed The Taj anyway, the fact that the Union insisted on the strike at the time it did doomed The Taj regardless of the result of the vote. The strike was, simply put, disruptive enough to cause The Taj to close almost as soon as possible.

It is difficult to say what might have happened had Icahn actually made the full amount of the investments that he promised had the Union not entered into the strike. One might presume that the property would have inevitably shuttered anyway and that it was not the property itself that made the result inevitable, but rather, the fact that the property was owned and operated by the reviled (at least, by gamblers) Carl Icahn. People may have their own opinions as to whether or not that is true, but Hard Rock International apparently believes so as they have purchased the property and reportedly plan to invest about 300 million into it.

Perhaps ironically, Hard Rock plans to invest 300 million into the property, and that is the very amount that Icahn claims to have lost during his ownership of the property. While no figure has been released, Icahn did say in January that he would have been happy to get back half of the money (150 million) he had lost throughout his time as owner of The Taj.

Hard Rock is certainly putting its money where its mouth is, but it seems, has always had an interest in New Jersey, in general. With a serious confidence in its brand, quite possibly fostered by a cross-marketing plan with its other properties, Hard Rock reportedly had interest in building a casino in Northern New Jersey had that November ballot measure been successful. Of course, the ballot measure failed, and that was out the window.

While the degree to which the talks went was unconfirmed, Hard Rock was also a name floated around as possibly being an interested party in the management of the former Revel Casino, which is to be renamed TEN, and will open...um...one of these days. Maybe.

Fortunately, Hard Rock plans to rehire many of the workers that lost their jobs when The Taj closed in October of last year, but unfortunately, it has been reported that the casino may not open until Summer of next year, a little bit over a year from now. In the interim, however, the renovation and rebranding of the property into the Hard Rock Casino Hotel will do wonders for some temporary construction jobs with the final result being permanent positions staffing the casino.

While the scope, extent and specifics of the renovations remains unknown, it is worth mentioning that Hard Rock’s pledged investment of roughly 300 million is more than some brand new construction casinos cost in their entirety, simply put, they’re not messing around!

Given that the Hard Rock is definitely going to reopen the former Trump Taj Mahal and that Glenn Straub, sooner-or-later (probably later) will finally manage to reopen TEN Casino in some capacity, one of the biggest questions on my mind is: What will this mean for the current players?

Many of you have probably read my report on Atlantic City’s performance last year and are aware that 2016-over-2015 was the first period of year-over-year improvement for A.C. in a decade largely driven by the performance of Internet Gaming, which obviously, did not even exist for the State of New Jersey in 2005. While that is good news for the industry, of course, it also means that most year-over-year gains in the years prior, for individual casinos, were largely due to other casinos closing.

We also took a look at January 2017 compared to January 2016 and were able to conclude that the city made modest casino win gains, as it had in December of 2016 compared to December of 2015, the emergence of a possible trend and stabilizing. The only problem with that is that the numbers reflect a growing stability rather than a huge improvement, to wit, the increase in total casino win was less than 6%, and again, partially driven by online gaming.

That in itself is not necessarily a problem, but what is a problem is the fact that 6% does not another casino make, and as a result, the opening of not just one definite casino (Hard Rock) but also of another, possibly before Hard Rock (TEN) could serve to throw the market back into instability and will have the result of casino operators again picking at the scraps to survive.

The problem is that, with exception to casinos such as Borgata, the question among the Atlantic City market for the last several years has not been, “Who is the healthiest,” but rather, “Can we avoid death long enough to give us a chance when someone weaker than us dies?” Recently, that answer was a resounding, “NO,’ for the Revel, Trump Taj Mahal, Atlantic Club, Trump Plaza and The Showboat. With that in mind, let’s take a look at who might be in the most trouble:

Resorts:

Resorts was able to outlast the Revel (of course, just about any property could have) and they were able to outlast The Taj, but can they outlast something far better than The Taj, run by a more competent company, in the same location? The fact is that Resorts v. Taj Mahal was the story of one run down shell of its former self taking on a casino that was never that opulent to begin with. The Hard Rock Casino Hotel will probably take all comers in the form of potential customers, and as Resorts is right next door, will probably target Resorts customers fairly aggressively.

Furthermore, Resorts was one of the casinos, even as far back as 2013, that were in the running for the, ‘Next casino to close.’ The fact of the matter is that Resorts may have won a major battle, but it is quite possible that the War of Attrition-A.C. is not yet over and that these one or two casino openings might be the next major pitched battle.

When it comes to the actual property, with exception to its location on the Boardwalk, there can be almost no doubt that Resorts is the most run down place in Atlantic City, as is made obvious by the revenues. Fortunately for them, they don’t have much in the way of debt, so they are pretty much okay as long as they can keep up with operating expenses.

That may not seem like a high ceiling, but barring seriously substantial improvement in the market, in general, a city that has seen five major casinos close in the last three years that is going to be opening two major casinos (both in locations of ones that had closed) within the next year-and-change is going to have to see some major changes in the market for those at-risk not to find themselves in the same boat.

While some of the most dreaded words in the last several years have been, “Too big to fail,” because those words so often prove untrue, that might even be the case with the Hard Rock Casino Hotel. Even in the event that it stumbles out of the gate, with the might of the casino company backing it, it’s quite reasonable that the property would be able to stay open, in the short-term, even if it falls only a little short of its operating costs. While that is arguably a luxury that Resorts may also enjoy, Resorts isn’t going to have the potential upside that the skeleton of The Taj + 300 million dollars pumped into it will have.

As far as TEN goes, I have less than zero confidence in that one. Maybe Glenn Straub will prove me wrong, he has certainly proved doubters wrong before, but he can’t even seem to get the thing open to this point.

Tropicana:

Tropicana is pretty healthy looking right now, especially given its success (not really) in converting former Taj players over to its side. Just looking at the raw casino win numbers, honestly, I’m surprised by how little the gains in Tropicana’s revenue seem to come from what was once Taj Mahal business. Personally, I really thought that Carl Icahn would find a way to do a better job of essentially keeping his own customers.

While not altogether seriously, (at least not as much so as Resorts or Bally’s) Tropicana was a name sometimes batted around as a potential country to fall in the War on Attrition. The reason that it wasn’t altogether serious was because it was always believed that Icahn would sooner close The Taj and try to divert as much of that business as possible to Tropicana.

While it is obviously the very same Carl Icahn that is selling the former Taj to Hard Rock, I think that it is almost akin to trading a very good backup quarterback to a team in your own Division, if I make an NFL comparison. Certainly, among the other Atlantic City visitors, many of them are currently visiting properties when they would prefer that The Taj be open and that they be at The Taj, and several of those people, presumably, are visiting Tropicana right now. In other words, I think what may be happening here is that Icahn may have successfully sold The Taj and is including a part of Tropicana’s market, though unwittingly, as part of the sale.

It bears reiteration that Carl Icahn is far from a beloved figure in Atlantic City, so the customers of Tropicana may largely be there because they feel they are comped the best there, and that may be true, if Free Play is a major draw for them. Once again, it would likely behoove the Hard Rock Hotel Casino to try to be, ‘All things to all people,’ upon opening, at least in the short-term, so expect them to attack the Tropicana (and others) full-on in an effort to get some of their most loyal customers.

Although, I must admit that I think Resorts and Bally’s are more at-risk, and while I don’t want to see ANY of the A.C. casinos close, if you told me that one and only one had to close, I would pick Tropicana. (Okay, as an AP, I wouldn’t, but from a perspective of, ‘Liking,’ a property, yeah, because I despise Carl Icahn).

I just don’t think it will happen. Tropicana is badly wounded, but survives.

Bally’s Atlantic City:

The fact of the matter is that this casino is almost completely redundant to Caesars and likely would simply divert much of its business to either Caesars or Harrah’s, likely Caesars. Apparently, in 2014, Bally’s was operating profitably by a pretty slim margin, and CET has already shown the capability to close properties that are actually profitable (Showboat-2014) if they think they can divert enough of its business to be more profitable as a company in the city.

In other words, they basically closed Showboat because they believed that the profit margin was so low that they could divert some of the guests to their other casinos such that the diverted customers would contribute enough money, with lesser additional offsetting expenses, that the profitable Showboat was still hurting CET’s overall interests in the city. Does it seem strange, initially, that a profitable establishment could actually be causing a company to make less money, perhaps, but in this case, it was probably true!

For those of you who might think closing a profitable casino and, despite diverting some of the employees to other CET properties, putting a non-zero number of people out of work would make CET an absolute pariah in the market, think again. The fact of the matter is that CET, and most notable Caesars Palace itself, has been showing some pretty incredible gains in both percentages and dollars and cents the last few months.

One exception to this trend is Bally’s, which remains largely stagnant with casino win only increasing in terms of fractions of percentage. While I don’t have access to any internal figures, the tale of the casino reporting tape kind of points to a strong possibility that Bally’s, while profitable, is not terribly profitable. We all know what CET does to not terribly profitable casinos when it can divert the customer base elsewhere, just ask Showboat.

The fact is that Bally’s is, was, and barring an absolutely unbelievable change in the fundamental market, forever will be a redundant casino. There’s a reason that it was said to be on the chopping block, and with the Hard Rock Casino Hotel likely to pull business from just about everywhere, and TEN, if it ever opens, likely to pull some business from Caesars Palace itself, it might make sense to close Bally’s and, again, divert the clientele.

Golden Nugget:

There was a time, in the bygone year of 2014, that The Nugget was considered one of the casinos most at risk of imminent closure. The former Trump Marina had a rocky story from its very inception under its original moniker, which itself almost didn’t happen.

Fortunately, the Golden Nugget managed to survive the first few of several battles in the Atlantic City War of Attrition, and coming out of it, not only managed to survive but also thrived in the new market environment.

The fact is that Golden Nugget did an unbelievable job marketing to the disaffected loyal customers of the five casinos that had found themselves shuttered within a period of under three years and thereby converted them into loyal Golden Nugget customers. They tier-matched, they pampered, they coddled and, perhaps most importantly, they were not afraid to disseminate the free play.

We see that Golden Nugget’s increases, both by dollars and cents as well as percentages, on a month-over-month basis have (while still improving) have not improved as dramatically as 2015-over-2014 and 2016-over-2015. During some of those months, Golden Nugget was only one of two or three casinos not to shed casino win compared to the same month of a prior year. The fact is that the marketing department took the ball, ran with it, and seemed like they were never going to look back.

I suppose the question now is whether or not the efficacy of their marketing is the same, or is it perhaps the case that they are simply hitting a ceiling on how much they can do? The fact of the matter is that some of the customers of casinos such as The Borgata or Caesars Palace are simply not interested in visiting the Golden Nugget and will never be interested in visiting the Golden Nugget. While I personally love GN, in terms of the eloquence and aesthetic appeal, it can not for a second hope to rival either of those other two casinos.

The fact remains, however, that Golden Nugget has shown a tremendous ability to market and seems to have retained several customers and turned them into extremely loyal visitors. It is almost undoubtable that these customers will pay the former Revel and Trump Taj Mahal a visit, just to look around and see, the question is how many of them will return to GN more often than not?

In my opinion, the Golden Nugget is fairly safe and it would take Resorts deciding to pack it in and perhaps even Bally’s, as well, before GN could ever be considered at risk. Resorts is simply playing with a very small margin no matter what it does and Bally’s is as stagnant as anything could possibly be. For those two casinos to close and The Nugget to still be in trouble would be indicative of far greater issues in the market, especially considering that would mean that there would be as many casinos as there are now.

Borgata, Caesars Palace, Harrah’s:

No chance in Hell! No way! Almost definitely not!

TEN (Formerly Revel):

This is an interesting possible scenario, the former Revel Casino reopens as TEN Casino with its batshit crazy owner Glenn Straub and becomes the first casino to close after its opening. While this may seem like an unusual occurrence, there is some historical precedent here, but also some differences:

For one thing, the original Revel closed not that long after opening (two years and change) but the fact then was that it cost over a billion to build and Glenn Straub picked it up for under a hundred million dollars that he, quite possibly, didn’t need to finance. With respect to carrying an operating profit over-and-above its debts, the Revel basically had absolutely no chance of doing so.

Furthermore, the Revel was absolutely mired by the incompetent leadership of former CEO Kevin DeSanctis. Prior to even placing the first chip on a Craps Table, DeSanctis thought that it would be a good idea to attempt to be even more of a mold breaker, to alienate and anger potential customers and to engage in the, well, bizarre!

First of all, DeSanctis both attempted to be too much of a mold breaker and alienated potential customers by deciding that the entire property should be non-smoking. As a former smoker, I can only conclude that DeSanctis engaged in almost zero market research prior to making this decision, and if he did engage in market research, he decided to pointedly do the exact opposite of what the market research would have suggested to be the best course of action.

The fact of the matter is that you simply do not find casinos that are willfully 100% non-smoking in areas in which there are casinos that allow smoking. Granted, there are non-smoking casinos and many of them do just fine, but they are NOT non-smoking by choice. In fact, many of these casinos (such as in the State of Ohio) have found some creative work-arounds to give patrons a place to smoke that still have a few machines. There are basically places to smoke indoors, they just aren’t technically indoors.

Interestingly enough, several of these casinos, such as the Hollywood Casino in Columbus, OH, do not have any competition that can permit smoking within roughly two driving hours! That’s how much they want to cater to smokers despite the law requiring them to meet the level of a non-smoking facility.

The bottom line is that an individual bar can get away with it, but for a major casino, you won’t find one that does not allow smoking if it can...because that’s a terrible, terrible business decision.

The next thing DeSanctis wanted to do was simply not have a buffet because he termed them, “Mass feederies.” Show of hands, how many newly opened major casinos lack a buffet, raise one hand for each one you’ve heard of. No, I can’t see you right now, but even if I could, I’d still be looking at zero hands.

After that, DeSanctis felt it would be a good idea to disparage both the weekend convenience gambler as well as the value gambler. For those of you who are at all familiar with Atlantic City, you may recognize that as 75% of the entire friggin’ market with 15% of the remaining 25% being locals!

While Straub, wisely, seems to plan to hire a casino management company, he is not the type of person to take losing money lightly. He has hinted at the possibility of just liquidating the entire place, and further, has a business history of being willing to ditch a losing investment in a hurry. It wouldn’t take many months of failure to meet operating expenses for Straub to shutter the place, and the operating expenses will be significant.

He’s also right, he could liquidate the place and get back a significant portion of his investment. Certainly not all of it, but enough that it would be better than permitting it to operate at a loss for several years...and less of a headache.

Hard Rock Hotel Casino:

I want to avoid the words, “Too big to fail,” but this is a long play for Hard Rock and they recognize that it could be a long play with many bumps along the way. The casino will open without any actual debt, and as long as it can come close to making operating expenses while showing some degree of future promise (pretty low standard) Hard Rock has the sort of money that they can (and will) continue to back it up.

Casino:

It will definitely be great to see The Taj reopen as the Hard Rock Casino Hotel, especially in conjunction with TEN Casino, if that manages to happen, to bring that end of the Boardwalk to almost its former glory.

Recreational and advantage players alike are sure to benefit from the increased competition for a limited market, however, it will spell uncertainty for some of the players in a market that seemed to be stabilizing. Regardless of the results, at least Atlantic City is always interesting!

sharpe 7 years ago

7 years ago

Couldn't agree more with you Brandon, cheers.

Please enter your comment.

Your comment is added.

Mission146 7 years ago

7 years ago

Sharpe, I agree with you, I suspect he'll be okay, even after Hard Rock puts Tropicana out of business! (Fingers crossed, but from an AP perspective, not really...I guess I'd also hate for the Trop people to lose their jobs) I can't bring myself to dislike Icahn enough to actually want the place closed. Cognitive...

Sharpe, I agree with you, I suspect he'll be okay, even after Hard Rock puts Tropicana out of business! (Fingers crossed, but from an AP perspective, not really...I guess I'd also hate for the Trop people to lose their jobs) I can't bring myself to dislike Icahn enough to actually want the place closed. Cognitive Dissonance gives me a headache!

Show morePlease enter your comment.

Your comment is added.

sharpe 7 years ago

7 years ago

Well if you're numbers are right Brandon then this is a significant loss...but I still won't be worried too much about his pension plan, what's the worst he could get...being multi millionaire instead of a billionaire, that's tough I guess ; )

Please enter your comment.

Your comment is added.

Mission146 7 years ago

7 years ago

Not much of a pension plan, if Icahn can be believed, he lost over 300 million during the time he ran The Taj, and just in January alluded to the fact that he would love just to sell it for half of what he lost. Definitely a positive short-term impact on jobs with potential for a few longer term ones.

Please enter your comment.

Your comment is added.

sharpe 7 years ago

7 years ago

Well at at least we could be calm about billionaire Carl Icahn pension plan now Wink Quote: ....by selling the property to Hard Rock International for an undisclosed amount. Of course now I'm curious how much is... that undisclosed amount after Hard Rock will invest 300 more millions in to it. The great part...

Well at at least we could be calm about billionaire Carl Icahn pension plan now Wink Quote: ....by selling the property to Hard Rock International for an undisclosed amount. Of course now I'm curious how much is... that undisclosed amount after Hard Rock will invest 300 more millions in to it. The great part though is that so many new work places will be created after that deal.

Show morePlease enter your comment.

Your comment is added.